If you’re dealing with accounting or finance, you’ve probably heard of the term “double-entry,” which forms the basis for the dual-accounting system. While it may seem complicated at first, getting it right can help you improve your business management and achieve greater success in your finance.

In this article, we will provide you with a detailed explanation of the concept of this entry and how it operates in the dual accounting system, as well as an explanation of its importance in analyzing financial statements and making prudent financial decisions.

Read on to learn more!

What is the Double Entry?

It is an accounting system based on the double recording of each financial transaction, where the value received is recorded in one account and the paid one in another account.

The system aims to ensure the accuracy and reliability of financial records and maintain their balance. In this system, the amount paid in a given account is regarded as the opposite of the other account, resulting in each financial transaction being recorded twice independently in the financial records.

Double-counting is essential in financial accounting, helping to determine the validity of financial statements and effectively control income and expenditure.

The Double Entry Theory

This theory is the basis of the dual accounting system, meaning that each financial transfer affects two different accounts in the account book. When funds are transferred from one account to another, this transfer is recorded in both the debt and the credit accounts in the accounting book.

Consequently, this transfer increases the balance in the credit account and reduces the balance in the debt account.

This theory is fundamental to double accounting, as it ensures that all financial movements are accurately tracked and accounting recordings are correctly confirmed.

By applying this theory, accountants can better analyze financial statements and make prudent financial decisions based on reliable accounting statements.

Importance of Double Entry

It is one of the most important bases of financial accounting because it ensures the accuracy and reliability of financial records and helps to determine the validity of financial statements and audits. Its importance is as follows:

- Maintains the balance of financial records

Each financial transaction is recorded twice independently in the financial records, thereby ensuring the balance of the accounting equation.

- Contributes to the validity of financial statements

By recording all financial transactions accurately and fairly, it can be used to verify the authenticity of the financial statements and ensure that there are no errors in them.

- Helps track income and expenditure

It can be used to track revenue and expenses effectively and determine production costs and profitability.

- Contribution to the preparation of financial reports

Used for the preparation of various financial reports, such as financial lists, tax reports, and administrative reports.

- Assists in auditing

It can be used in the financial audit process to verify the authenticity of the financial records and confirm that there are no errors in them.

In addition, double-entry is used in many other areas, such as banks and international trade, and is essential in holding different companies and institutions accountable, contributing to transparency and credibility in financial transactions and helping to make the right financial decisions.

Examples of double-entry

Used in accounting to record financial transactions in an accurate and reliable manner, the double-entry includes recording the financial transaction in at least two accounts, where the debited value is recorded in one account and the credited value is recorded in another account.

We will give you some examples of double entry:

- When buying $10,000 worth of goods in cash

Double-entry registration will be as follows:

– Record $10,000 in an inventory account (debited account), because the company bought goods.

– Record $10,000 in cash account (creditor account), because the company paid the price in cash.

- Sale of goods worth $ 5,000 after delivery to the customer

Double-entry registration will be as follows:

– Registration of $5,000 in cash account (debtor account), because the company received the amount in cash.

– Registration of $5,000 in sales account (creditor account), because the company sold goods worth $5,000.

- Pay employees $8,000 in salaries

Double-entry registration will be as follows:

– $8,000 in payroll account (debited account), because the company paid employees’ salaries.

– $8,000 in cash account (creditor account), because the company paid the amount in cash.

These are some examples of double counting, which companies use to record all financial transactions, including revenue, expenses, assets, liabilities, capital, taxes, etc.

What is the Double Entry for a Liability?

In accounting, the double entry system is a method that ensures the accounting equation (Assets = Liabilities + Equity) remains in balance after every transaction. Each transaction affects at least two accounts in ways that keep the equation balanced. When dealing with liabilities, understanding the double entry system is crucial for accurate financial reporting.

Definition of Liability: In financial accounting, a liability is defined as an obligation of an entity arising from past transactions or events, the settlement of which may result in the transfer or use of assets, provision of services, or other yielding of economic benefits in the future.

Double Entry for a Liability: When an entity incurs a liability, it means that it has obtained either goods, services, or financing that will need to be paid back in the future. The double entry accounting system requires recording this event with two entries:

- Credit Entry: The liability account is credited to increase its balance, reflecting the entity’s obligation to pay in the future. Liabilities are increased on the credit side because, in the accounting equation, they are on the opposite side of assets, which are increased with a debit.

- Debit Entry: Simultaneously, another account must be debited to balance the transaction. The debit entry could be to an expense account if the liability was incurred to purchase goods or services. If the liability was incurred by borrowing money, the debit would be to a cash or cash equivalents account, indicating an increase in the entity’s assets.

Example: Suppose a business takes out a loan of $10,000 from a bank. The double entry would be:

- Debit Cash Account (Asset): $10,000 (increase in assets)

- Credit Bank Loan Account (Liability): $10,000 (increase in liabilities)

This transaction shows that the business has increased its assets (cash) by $10,000 and simultaneously increased its liabilities (bank loan) by $10,000, keeping the accounting equation balanced.

What is the Double Entry of Cash?

Cash transactions are a fundamental part of business operations, and understanding their double entry accounting treatment is essential for accurate bookkeeping.

Definition of Cash: Cash includes currency, coins, and deposits in bank accounts that are readily available for use in paying off liabilities or making purchases.

Double Entry for Cash: Every cash transaction affects the cash account and at least one other account in the business’s accounting records. The direction of the effect (increase or decrease) on the cash account depends on the nature of the transaction.

- Receiving Cash: When a business receives cash, it debits the cash account to reflect an increase in assets.

- Paying Cash: When a business pays cash, it credits the cash account to indicate a decrease in assets.

Examples:

- Receiving Cash: If a company sells products for $5,000 in cash, the double entry would be:

- Debit Cash Account: $5,000 (increase in assets)

- Credit Sales Revenue Account: $5,000 (increase in equity through increased revenue)

- Paying Cash: If the same company pays $2,000 in cash for rent, the double entry would be:

- Debit Rent Expense Account: $2,000 (increase in expenses, reducing equity)

- Credit Cash Account: $2,000 (decrease in assets)

These examples illustrate how cash transactions are recorded in the double entry system, ensuring that for every action, there is an equal and opposite reaction in the accounts, maintaining the balance of the accounting equation.

What is the difference between single entry and double entry?

The primary difference between single entry and double entry accounting lies in the approach to recording financial transactions.

- Single Entry System: This is a simplistic and informal method of bookkeeping, where transactions are recorded only once, either as an expense or income, without the need for recording the corresponding dual effect in two separate accounts. This system is typically used by small businesses and for personal finances. It does not provide a comprehensive view of the financial position of a business because it does not follow the double-entry bookkeeping principle of recording both sides of each transaction.

- Double Entry System: This method is based on the accounting equation that states that assets = liabilities + equity. Every transaction is recorded in at least two accounts: a debit in one account and an equal, offsetting credit in another. This system provides a complete record of financial transactions, allowing for the preparation of accurate financial statements. It is considered the standard for professional accounting and is used by most companies, regardless of size.

Advantages and Disadvantages of Double Entry

Advantages:

- Accuracy and Completeness: The double entry system helps in ensuring the accuracy of the financial statements by recording both aspects of every transaction. This completeness helps in detecting and preventing errors and frauds.

- Financial Statement Preparation: It allows for the preparation of a complete set of financial statements, including the balance sheet, income statement, and cash flow statement, which are essential for the analysis of business performance.

- Accountability: By recording each transaction in multiple accounts, it ensures greater accountability and traceability of financial data.

- Financial Analysis and Decision Making: The comprehensive data provided by double-entry bookkeeping supports more detailed financial analysis and informed decision-making.

Disadvantages:

- Complexity: The double entry system is more complex to understand and implement, especially for those without a background in accounting. This might require hiring skilled accountants.

- Time-Consuming: Recording transactions in multiple accounts can be more time-consuming than single entry bookkeeping.

- Cost: Due to its complexity, the double entry system might lead to higher costs for accounting and bookkeeping services compared to the single entry system.

Each system has its place, depending on the size, complexity, and needs of the business. While the single entry system may suffice for very small businesses and personal finances, the double entry system offers a more detailed and accurate picture of a company’s financial health, making it indispensable for larger businesses and those requiring detailed financial analysis.

What is a double record in accounting?

A double record is one of the foundations of financial accounting, where each financial transaction is recorded twice separately, in order to ensure the balance of the accounting equation. The dual register is accurate and reliable in recording financial transactions, which helps to determine the validity of financial statements and audits.

Thus, companies and institutions must adhere to the double record to achieve the accuracy and reliability of financial records and maintain their balance.

Accounting constraints and their types

Accounting constraints are one of the basic methods used in financial accounting to record organizations’ financial activities, and accounting constraints mean that payments and financial acceptances are written into accounting records in accordance with certain accounting standards.

Accounting constraints are the recording of various operations occurring in the enterprise, such as procurement, sales, salaries, wages, income and expenses. The types of accounting constraints are as follows:

Purchase constraint

Purchases are recorded in suppliers’ accounts and the value paid is recorded in the treasury or bank account.

Sales constraint

By recording sales in customers’ accounts and the outstanding value is recorded in the sales account.

Salary and wage constraint

Includes the registration of salaries and wages in employees’ accounts and the value paid is recorded in the treasury or bank account.

Revenue entry

Revenue is recorded in various revenue accounts, and due value is recorded in sales accounts.

Charging of expenses

Expenses are recorded in various expense accounts and the value paid is recorded in the treasury or bank account.

Depreciation entry

The value of non-expendable assets is recorded in the fixed asset accounts and depreciation is recorded in the accumulated expense account.

Discounts and sales constraints

The value of discounts is recorded in sales and procurement accounts.

What is the Difference Between Double Entry and Compound Entry?

When discussing double entry and compound entry in accounting, it’s important to distinguish between these two fundamental concepts.

Double entry: is the basis of accounting and relies on the principle that every financial transaction has a dual impact, affecting two sides of the accounts: the credit side and the debit side. This means that each transaction is recorded twice, once as a debit and once as a credit.

Compound entry is a technique used in double entry accounting where several financial transactions are recorded in one entry. In this case, there can be more than one credit and/or debit account in a single entry. The purpose of compound entries is to simplify and organize accounting recordings more effectively, especially when dealing with complex transactions

Double entry is a fundamental accounting principle that ensures every transaction is recorded in two different sides to maintain balance in the accounts. Compound entry, meanwhile, is a practical application of this principle, allowing for the recording of multiple changes in different accounts in one entry for efficiency and accuracy in accounting recordings.

In addition, there are many other accounting constraints that are used in accordance with the organization’s financial needs and the nature of its activity.

Accounting constraints are frequently used in financial accounting to record financial transactions accurately and reliably, to determine the authenticity of financial statements, and to provide accurate financial information to the management and shareholders of the organization.

Based on the foregoing, it can be argued that double-counting is the basis of financial accounting and ensures the accuracy and reliability of financial records. It helps determine the validity of financial statements and audits and contributes to transparency and credibility in financial transactions.

It is used in many areas, such as banks and international trade, and is essential in holding different companies and institutions accountable.

Thus, companies and institutions must adhere to it; to achieve accuracy and reliability of financial records and maintain their balance.

At Accounts Quality Company, we understand the complexities of financial management and the importance of accurate accounting for businesses of all sizes. Our comprehensive range of accounting services is tailored to meet your unique business needs, ensuring financial clarity and compliance.

Why Choose Accounts Quality Company?

- Personalized Services: We offer customized accounting solutions that align with your business goals. Explore our accounting record organization services.

- Experienced Professionals: Our team of certified accountants brings expertise and industry knowledge to ensure the best for your business.

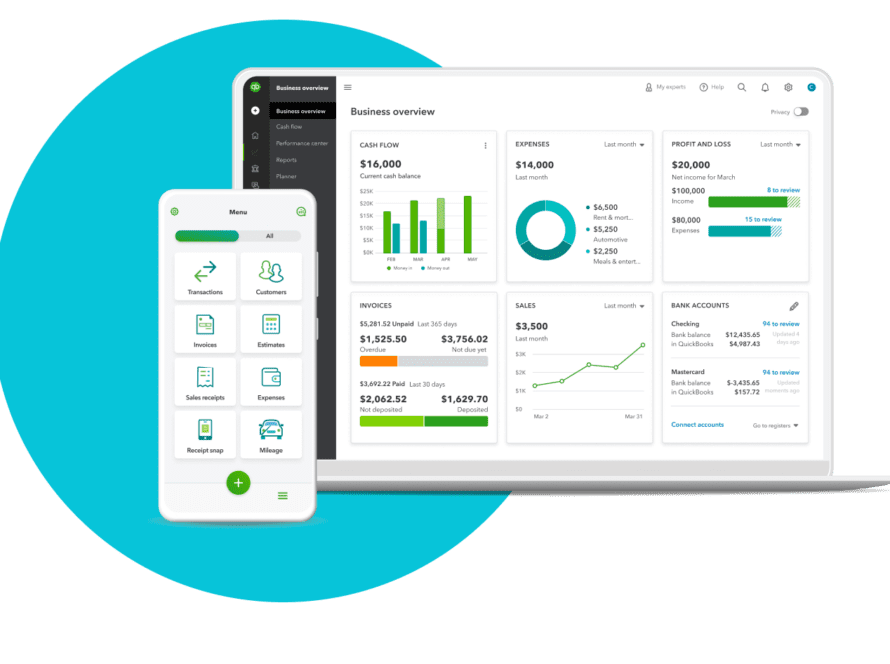

- Advanced Technology: Utilizing the latest accounting software and tools for efficient financial management. Discover our integrated accounting software solutions.

- Compliance Assurance: Stay up to date with financial regulations and tax laws with our expert services. Learn more about our tax and consulting services.

- Dedicated Support: Our commitment to your success is reflected in our unwavering support and advice.